AP Direct Invest Pty Ltd is a Corporate Authorised Representative (001295396) of Alman Partners Pty Ltd (AFSL: 222107)

Smart Brisbane Investors DON'T Gamble—They Plan. Do You Have a Real Wealth Strategy?

Investing Isn’t Just for the Ultra-Rich

Have $300,000+? Don’t Let It Sit—Put It to Work with Proven Wealth Strategies.

Evidence-Based Wealth Strategies

No Commissions, No Conflicts—100% Independent

Your wealth deserves expertise, not guesswork. Our team provides the insight and strategy to help you take control and pursue what matters most with confidence.

Wealth is about choices. Let’s create a strategy that gives you complete financial confidence and a high probability of achieving your most important goals.

Serious About Wealth Growth? Work with a Team of Elite Financial Experts.

40 years of proven financial strategies. No guesswork—just results.

Real Clients. Real Success. See Why Investors Trust Alman Partners.

Don’t just take our word for it—hear from investors who have secured their financial future with our proven strategies.

Are We the Right Fit for You?

Looking for Proven Financial Strategies? Speak to an Expert

An Investors with $300,000+ in Investable Assets

A Business Owners, Professionals, and Retirees Seeking Wealth Growth

Seeking a Strategic, Long-Term Financial Plan (Not Quick Fixes)

Someone Who Wants Confidence in Their Financial Future

Here’s How the Smartest Investors Multiply Their Wealth.

Smart money doesn’t guess—it follows proven, high-performance financial strategies. Alman Partners has been guiding Brisbane elite investors for 40 years.

Tailored Investment Strategies for Your Financial Goals

At Alman Partners, we don’t believe in one-size-fits-all investing. Our evidence-based model portfolios are built around your unique financial situation, risk tolerance, and long-term objectives.

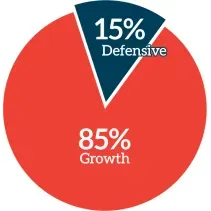

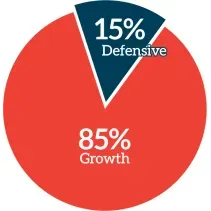

AP High Growth

AP

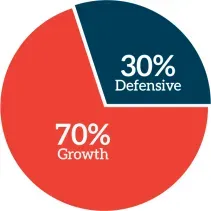

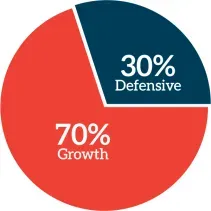

Growth

AP

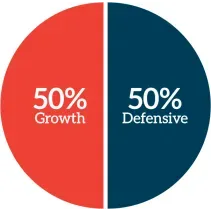

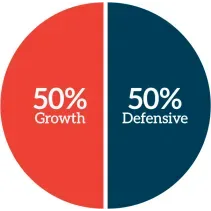

Balanced

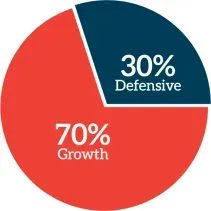

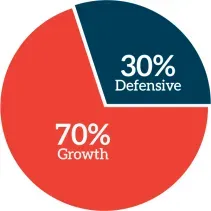

AP Moderately Conservative

AP ESG High Growth

AP ESG Balanced

Elite Financial Planning for Serious Investors

We don’t just manage money—we build your future.

Your wealth isn’t just about numbers; it’s about freedom, security, and the life you want.

Our evidence-based, tailored financial strategies ensure you have a clear path to achieving your True Wealth, whatever that looks like for you.

Investing Without a Plan? That’s a Risk You Can’t Afford.

Get your money working as hard as you. Get a strategy that works.

Why Choose Alman Partners?

Expert Financial Planning That’s Independent, Evidence-Based, & Designed Specifically for you.

40 Years of Experience

100% Independent

Your Investment Fiduciary

Tailored Wealth Management for High-Net-Worth Clients

Evidence-Based Investment Strategies (No Market Timing or Stock Picking)

Brisbane Based Team with Global Connections

Award-Winning Firm (FAAA Professional Practice of the Year 2022)

Comprehensive Financial Planning Tailored to Your Needs

Wealth Accumulation & Investment Advice – long term strategies with expert guidance

Superannuation & Retirement Planning – Ensure a comfortable retirement with evidence-based planning.

Estate & Taxation Strategies – Protect your wealth for future generations with smart financial planning.

Business & Intergenerational Wealth Transfers – Secure your legacy with strategic financial planning.

Your Wealth. Your Goals. Your Custom Investment Plan.

Tired of generic, cookie-cutter investment advice? We build tailored model portfolios designed to help high-net-worth investors like you achieve real financial success.

AP High Growth

Investment Objective

The portfolio seeks to maximise medium to long term capital growth opportunities by investing in growth assets with a moderate allocation to defensive cash/fixed interest assets. Investment managers seek to eliminate exposure to controversial business activities and prioritise investing in companies that embrace high environmental, social and governance (ESG) standards.

Typical Investors

In general, this portfolio is designed for investors with an investment time horizon of at least 7 years, who are seeking moderate levels of capital growth with some income assets, are prepared to accept moderately high short to medium-term volatility, who wish to combine traditional investment approaches with environmental, social and governance insights and outsource the construction and management of their underlying portfolio holdings.

Investment Strategy and Approach

The investment strategy centres on a strategic asset allocation approach, built on low-cost ETF’s designed to capture market returns in a broadly diversified manner. The portfolio will include moderate holdings in cash/fixed interest and listed Australian property with the majority of exposures focused on equities, both Australian and international. Exposure is adjusted to take into account certain environmental and sustainability impacts and social considerations.

The portfolio targets a 10-year annualised gross return of 8.2% with an expected negative return occurring on average once every 5 to 7 years. Alman Partners investment committee monitors the portfolio within set tolerance bands for each underlying investment and it may rebalance the portfolio from time to time.

Indicative number of holdings 6 to 10

Asset allocation ranges (%)

Asset type:

Cash - Minimum 0% Maximum 5%

Australian Shares - Minimum 50% Maximum 70%

International Shares - Minimum 20% Maximum 40%

Australian Property - Minimum 0% Maximum 15%

International Property - Minimum 0% Maximum 0%

Australian Fixed Interest - Minimum 0% Maximum 5%

International Fixed Interest - Minimum 0% Maximum 0%

Alternatives - Minimum 0% Maximum 0%

Other - Minimum 0% Maximum 0%

Growth

Investment Objective

The portfolio seeks to maximise long term capital growth opportunities by investing in growth assets with a moderate allocation to defensive cash/fixed interest assets.

Typical Investor

In general, this portfolio is designed for investors with a long-term investment time horizon of at least 7 years, seeking high levels of capital growth, prepared to accept short to medium-term volatility, and who wish to outsource the construction and management of their underlying portfolio holdings.

Investment Strategy and Approach

The investment strategy centres on a strategic asset allocation approach, built on low-cost ETF’s designed to capture market returns in a broadly diversified manner, with specific tilts incorporated to target higher expected returns. The portfolio will include moderate exposure to cash/fixed interest and listed Australian property, with the majority of exposure focused on equities, both Australian and international.

The portfolio targets a 10-year annualised gross return of 8.8% with an expected negative return occurring on average once every 5 – 7 years. Alman Partners investment committee monitors the portfolio within set tolerance bands for each underlying investment and it may rebalance the portfolio from time to time.

Indicative number of holdings 6 to 10

Asset allocation ranges (%)

Asset type:

Cash - Minimum 0% Maximum 5%

Australian Shares - Minimum 40% Maximum 60%

International Shares - Minimum 20% Maximum 30%

Australian Property - Minimum 0% Maximum 10%

International Property - Minimum 0% Maximum 0%

Australian Fixed Interest - Minimum 0% Maximum 0%

International Fixed Interest - Minimum 10% Maximum 20%

Alternatives - Minimum 0% Maximum 0%

Other - Minimum 0% Maximum 0%

AP Balanced

Investment Objective

The portfolio seeks to maximise medium to long term capital growth opportunities by investing in growth assets with a moderate allocation to defensive cash/fixed interest assets.

Typical Investor

In general, this portfolio is designed for investors with a medium-term investment time horizon of at least 5 years, seeking moderate levels of capital growth with some income assets, and prepared to accept moderately high short to medium-term volatility, and who wish to outsource the construction and management of their underlying portfolio holdings.

Investment Strategy and Approach

The investment strategy centres on a strategic asset allocation approach, built on low-cost ETF’s designed to capture market returns in a broadly diversified manner, with specific tilts incorporated to target higher expected returns. The portfolio will be diversified primarily across equities, both Australian and international, with moderate exposure to cash/fixed interest and listed Australian property.

The portfolio targets a 10-year annualised gross return of 8.2% with an expected negative return occurring on average once every 5 – 7 years. Alman Partners investment committee monitors the portfolio within set tolerance bands for each underlying investment and it may rebalance the portfolio from time to time.

Indicative number of holdings 6 to 10

Asset allocation ranges (%)

Asset type:

Cash - Minimum 0% Maximum 5%

Australian Shares - Minimum 35% Maximum 45%

International Shares - Minimum 15% Maximum 25%

Australian Property - Minimum 0% Maximum 10%

International Property - Minimum 0% Maximum 0%

Australian Fixed Interest - Minimum 10% Maximum 20%

International Fixed Interest - Minimum 10% Maximum 20%

Alternatives - Minimum 0% Maximum 0%

Other - Minimum 0% Maximum 0%

AP Moderately Conservative

Investment Objective

The portfolio provides a mixed exposure between income and capital growth opportunities but is more weighted towards consistent income distribution

Typical Investor

The portfolio is designed for investors with a medium-term investment time horizon of at least 3 to 5 years, seeking moderate levels of income and capital growth, prepared to accept short to moderate volatility, and who wish to outsource the construction and management of their underlying portfolio holdings.

Investment Strategy and Approach

The investment strategy centres on a strategic asset allocation approach, built on low-cost ETF’s designed to capture market returns in a broadly diversified manner, with specific tilts incorporated to target higher levels of income. The portfolio will be diversified across Australian Equities, International Equities, Property, High Yield Income Securities, Income Securities and Cash.

The portfolio targets a 10-year annualised gross return of 6.4% with an expected negative return occurring on average once every 7 years. Alman Partners investment committee monitors the portfolio within set tolerance bands for each underlying investment and it may rebalance the portfolio from time to time.

Indicative number of holdings 6 to 10

Asset allocation ranges (%)

Asset type:

Cash - Minimum 0% Maximum 5%

Australian Shares - Minimum 25% Maximum 35%

International Shares - Minimum 10% Maximum 20%

Australian Property - Minimum 0% Maximum 10%

International Property - Minimum 0% Maximum 0%

Australian Fixed Interest - Minimum 35% Maximum 45%

International Fixed Interest - Minimum 5% Maximum 15%

Alternatives - Minimum 0% Maximum 0%

Other - Minimum 0% Maximum 0%

AP ESG High Growth

Investment Objective

The portfolio seeks to maximise long term capital growth opportunities with income distributions being of secondary consequence. Investment managers seek to eliminate exposure to controversial business activities and prioritise investing in companies that embrace high environmental, social and governance (ESG) standards.

Typical Investors

In general, this portfolio is designed for investors seeking high levels of capital growth, prepared to accept short to medium-term volatility, and who wish to combine traditional investment approaches with environmental, social and governance insights. The portfolio has a long-term investment time horizon of at least 7 years.

Investment Strategy and Approach

The investment strategy centres on a strategic asset allocation approach, built on low-cost ETF’s designed to capture market returns in a broadly diversified manner. The portfolio will include limited holdings in cash and listed Australian property with the majority of exposures focused on equities, both Australian and international. Exposure is adjusted to take into account certain environmental and sustainability impacts and social considerations.

The portfolio targets a 10-year annualised gross return of 9% with an expected negative return occurring on average once every 5 years. Alman Partners investment committee monitors the portfolio within set tolerance bands for each underlying investment and it may rebalance the portfolio from time to time.

Indicative number of holdings 5 to 10

Asset allocation ranges (%)

Asset type:

Cash - Minimum 0% Maximum 5%

Australian Shares - Minimum 30% Maximum 50%

International Shares - Minimum 50% Maximum 60%

Australian Property - Minimum 0% Maximum 0%

International Property - Minimum 0% Maximum 0%

Australian Fixed Interest - Minimum 0% Maximum 0%

International Fixed Interest - Minimum 0% Maximum 0%

Alternatives - Minimum 0% Maximum 0%

Other - Minimum 0% Maximum 0%

AP ESG Balanced

Investment Objective

The portfolio seeks to maximise medium to long term capital growth opportunities by investing in growth assets with a moderate allocation to defensive cash/fixed interest assets. Investment managers seek to eliminate exposure to controversial business activities and prioritise investing in companies that embrace high environmental, social and governance (ESG) standards.

Typical Investors

In general, this portfolio is designed for investors with an investment time horizon of at least 7 years, who are seeking moderate levels of capital growth with some income assets, are prepared to accept moderately high short to medium-term volatility, who wish to combine traditional investment approaches with environmental, social and governance insights and outsource the construction and management of their underlying portfolio holdings.

Investment Strategy and Approach

The investment strategy centres on a strategic asset allocation approach, built on low-cost ETF’s designed to capture market returns in a broadly diversified manner. The portfolio will include moderate holdings in cash/fixed interest and listed Australian property with the majority of exposures focused on equities, both Australian and international. Exposure is adjusted to take into account certain environmental and sustainability impacts and social considerations.

The portfolio targets a 10-year annualised gross return of 8.2% with an expected negative return occurring on average once every 5 to 7 years. Alman Partners investment committee monitors the portfolio within set tolerance bands for each underlying investment and it may rebalance the portfolio from time to time.

Indicative number of holdings 6 to 10

Asset allocation ranges (%)

Asset type:

Cash - Minimum 0% Maximum 5%

Australian Shares - Minimum 25% Maximum 35%

International Shares - Minimum 30% Maximum 45%

Australian Property - Minimum 0% Maximum 0%

International Property - Minimum 0% Maximum 0%

Australian Fixed Interest - Minimum 0% Maximum 0%

International Fixed Interest - Minimum 25% Maximum 35%

Alternatives - Minimum 0% Maximum 0%

Other - Minimum 0% Maximum 0%

What Our Clients Say

We are very grateful that our association with Alman Partners began over 22 years ago. Their expert advice and guidance over that time is enabling us to live our life exactly as we want, at a time when we are still healthy and young enough to be able to enjoy ourselves with no concerns about our financial future.

Barry & Carol

The honesty from Alman Partners is appreciated and goes a long way with us! The team go above & beyond and we truly respect that in so many ways. Having our back (financially) in some form is very refreshing!

Micahel & Melissa

I am very happy with the service given. I can talk to Niyati freely and trust what she says. The Advice provided, I followed and understand. I appreciate all the professional help given. All the staff are very friendly and lovely. I am very impressed.

Duncan

Rob and I have been super impressed with the service that Alman Partners provides! Our primary thought was that we should have seen them years ago, and prior to getting started, Rob was one of the more sceptical and untrusting of the industry! We want to share our recommendation of Alman Partners’ services with others, especially those younger than us, so they have the opportunity of acting sooner than we have.

Rob & Kerry

What Our Clients Say

We are very grateful that our association with Alman Partners began over 22 years ago. Their expert advice and guidance over that time is enabling us to live our life exactly as we want, at a time when we are still healthy and young enough to be able to enjoy ourselves with no concerns about our financial future.

Barry & Carol

The honesty from Alman Partners is appreciated and goes a long way with us! The team go above & beyond and we truly respect that in so many ways. Having our back (financially) in some form is very refreshing!

Micahel & Melissa

I am very happy with the service given. I can talk to Niyati freely and trust what she says. The Advice provided, I followed and understand. I appreciate all the professional help given. All the staff are very friendly and lovely. I am very impressed.

Duncan

Rob and I have been super impressed with the service that Alman Partners provides! Our primary thought was that we should have seen them years ago, and prior to getting started, Rob was one of the more sceptical and untrusting of the industry! We want to share our recommendation of Alman Partners’ services with others, especially those younger than us, so they have the opportunity of acting sooner than we have.

Rob & Kerry

Frequently Asked Questions

What types of investment plans do you offer?

We offer a variety of plans, including retirement savings, wealth growth, and risk-managed portfolios, tailored to your goals.

How do you ensure my investments are secure?

We use diversified strategies and thorough market analysis to minimize risks and protect your assets.

Can I adjust my investment plan later?

Yes, your portfolio is regularly reviewed, and adjustments can be made to align with changing goals or market conditions.

Is there a minimum investment amount required?

The minimum varies depending on the plan, but we offer options suitable for a wide range of financial needs.

Get In Touch

Hours

Monday to Thursday: 8:00 am – 4:30 pm

Friday: 8:00 am – 3:30 pm

Saturday to Sunday: Closed

Disclaimer:

The AP Direct Invest platform is designed for self-directed investors and does not include any personalised advice.

If you feel your circumstances need full-service financial planning and ongoing support, head to Alman Partners’ Service Overview to learn more about our available offerings.

AP Direct Invest Pty Ltd: Website Disclosure Information (WDI)

AP Direct Invest Pty Ltd is a Corporate Authorised Representative (001295396) of Alman Partners Pty Ltd (AFSL: 222107)

Disclaimer:

OpenInvest Limited (ACN 614 587 183 AFSL 504 155) has appointed Alman Partners Pty Ltd (AFSL 222107) as the portfolio manager for various model portfolios it is the responsible entity for. Alman Partners Pty Ltd has prepared this website for general information purposes only. It does not contain investment recommendations nor provide investment advice as to the suitability of the financial product to meet your needs or objectives.

We strongly encourage you to obtain professional advice from an accredited financial adviser authorised to provide you with personal financial advice to determine the suitability of the financial product for you.

A Product Disclosure Statement (PDS) issued by OpenInvest Limited can be obtained via the OpenWealth service by clicking on the Start Investing link that appears above. You should read the PDS prior to investing as it contains information that will assist you in deciding whether the service is suitable for you and which of the model portfolios is suitable for you. A summary of the six portfolios that are available is provided above. You should refer to the PDS to decide which option may be suitable to your needs and objectives.

To find out more information about Alman Partners Pty Ltd, see above links.

Please see our Privacy Policy that describes how we collect and deal with information on persons visiting this website.